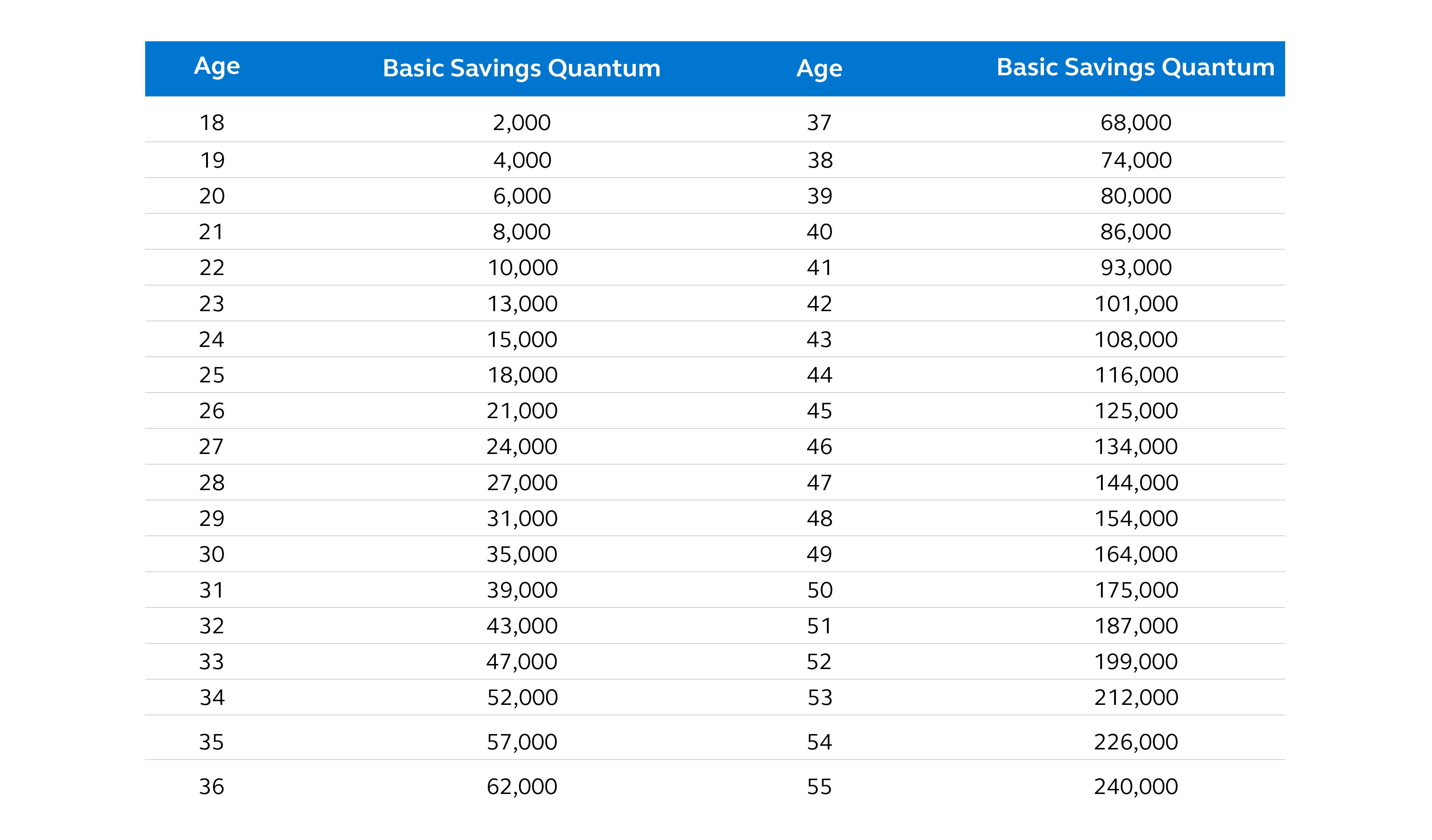

Net savings per. New Basic Savings Quantum Begins January 2017.

Average Savings By Age Uk Statista

The average transaction account balance for respondents 55 to 64 years of age was 57670 in 2019 the second-highest amount.

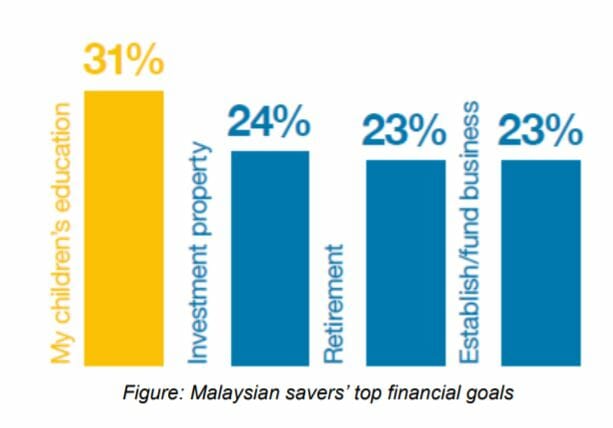

. The average wealth expectancy of Malaysians with enough disposable income to save and invest is RM4 million or RM1324000 for the emerging affluent RM1740000 for the affluent and RM9348000 for HNWIs. When it comes to savings being average is a bad thing. Respondents average saving per month in Malaysia 2019.

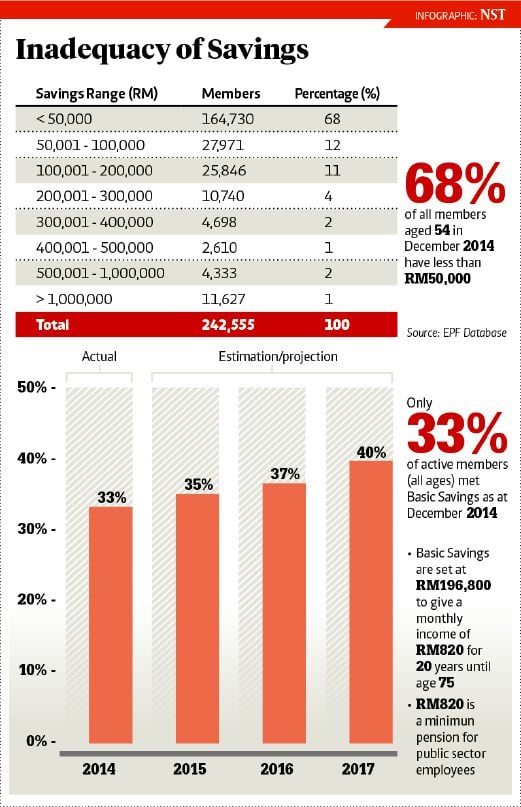

The average Millennial ages 25 to 40 has 51300 in personal savings and 63300 in retirement accounts. According to the Visa Financial Literacy Study 2018 53 of Malaysians are saving to prepare for their futures while 22 do not keep track of their savings and spending. According to EPF 70 of Malaysians who withdrew their savings at age 55 use it up in less than 10 years.

Mens overall average savings. Average Savings by Age. Hi thereIve always wondered how much does an average Malaysian earn or save by the age of 22Im trying to ask this as an evaluation of the current financial condition of Malaysian youths as well as an evaluation of how I am doing as of nowA brief introduction about myselfI am currently 22 years old and am still an undergrad student studying my.

Note that average does not mean optimal for savings by age. 67 of Malaysians earning between RM5000 to RM10000 a month save less than RM1000 monthly. KUALA LUMPUR 30 September 2016.

We found that. This means a monthly retirement income of the only RM950 per month assuming a life expectancy of 75 years old. At this stage of life its prudent to save up that three-to six-month savings account to cover the.

70 Of Malaysians Outlive Their Retirement Savings Heres How Not To. 52330 Retirement savings needed. The 2019 Federal Reserve Survey of Consumer Finances found that Americans between the ages of 35 and 44 had an average savings account balance of 27900.

88 of Malaysians earning between RM2000 to RM5000 a month save less than RM1000 monthly. The Employees Provident Fund. In 2018 the highest share of respondents saving.

Malaysias wealth expectancy. Personal savings went from 66K to 73K while the average retirement fund jumped from 875K to 99K. During this decade earnings grow.

Our life expectancy is also steadily increasing to about 75 years - so it is important to build enough savings. Those findings are based on Northwestern Mutuals 2021 Planning Progress Study. The Basic Savings refers to the amount that is considered sufficient to support our members basic retirement needs for 20 years from age 55 to 75 aligned with the Malaysian life expectancy.

Since the data isnt broken down any further it is difficult to say how much more 30 years old have saved than 25-year-olds. The median earnings are 1022 a week or 53144 a year. Gross savings per capita in Denmark 2009-2020.

So where do you stand. The average cost of raising a child to the age of 18 is 233610 or about 14000 a year. On top of that only 9 of the people with retirement savings had to spend some of those savings to get by.

Womens overall average savings. Dec 4 2019. Malaysians are saving less nowadays a possible sign that people are not earning enough to keep up with their debt paymentsTo put things into perspective the absolute amount of individual savings in banks has been growing year-on-year.

Between the ages of 35 and 44 the average non-retirement savings balance is 20839. The account balances of the 5564 age group kept a close. The amount will be set as the minimum target EPF savings members should have when they reach.

The new quantum refer to Table 1 is benchmarked against the minimum pension for public sector employees which has been raised from RM820 to RM950. However in 2021 the personal and retirement savings of regular American citizens saw a decent boost 10 and 13 respectively. Suppose you make 50000 per year.

Hi there Ive always wondered how much does an average Malaysian earn or save by the age of 22Im trying to ask this as an evaluation of the current financial condition of Malaysian youths as well as an evaluation of how I am doing as of nowA brief introduction about myselfI am currently 22 years old and am still an undergrad student studying my. If thats not shocking there are other alarming statistics reported last year. Mean amount in cash savings in the United Kingdom UK 2017 by age group.

At this stage more people are homeowners and parents of young children. 5 Best Places To Travel on a 1000 Budget. Last year the Employees Provident Fund EPF raised the minimum savings target to RM228000 by the age of 55.

837287 More From GOBankingRates. Whats crystal clear is extremely worrying. 31 of Malaysians earning above RM10000 a month save less than RM1000 monthly.

Gross domestic savings of GDP in Malaysia was reported at 2618 in 2020 according to the World Bank collection of development indicators compiled from officially recognized sources. Whether it is saving investing insurance or managing money the financial health of an average Malaysian highly depends on these fundamentals. The Federal Reserve study found that people under the age of 35 had an average savings of 34780.

Those in this age bracket are now well into adulthood. On average Malaysians has RM17800 per month to live on during retirement which is slightly less than. However the pace of growth weakened in 2017 compared with previous yearsFor example savings.

By this logic you should have at least 50000 saved at 30. 64 Annual cost of a comfortable retirement. Although men appear to have more saved overall than women our survey revealed that less than a quarter of men have 1000 or less in savings but.

You should have much more than that. Malaysia - Gross domestic savings of GDP - actual values historical data forecasts and projections were sourced from the World Bank on April of 2022. Looking at the middle 66 of people we surveyed we can see a disparity between male and female savers.

Why is financial retirement planning so important. EPF today announces that the quantum for the Basic Savings will be revised from RM196800 to RM228000 effective 1 January 2017. According to a survey conducted in Malaysia in 2019 about 35 percent of respondents saved less than 500 Malaysian Ringgit monthly.

Is Rm4 Million Enough For Retirement Businesstoday

Canada Savings Per Household By Age Group 2021 Statista

Malaysia Average Monthly Saving 2019 Statista

The Impact Of Rapid Aging And Pension Reform On Savings And The Labor Supply In Imf Working Papers Volume 2019 Issue 061 2019

Average Savings Of Epf Members At 54 Years Of Age Download Table

What Is The Ideal Savings According To Age Bracket Principal Asset Management

China S High Savings Drivers Prospects And Policies In Imf Working Papers Volume 2018 Issue 277 2018

Savings Rate By Age Malaysians Download Table

According To Recent Figures From The Employees Provident Fund Epf The Approximately 70 000 Active 54 Year Old Contributors Have An Pensions Finance Poverty

Educating Malaysians On Retirement Savings

Average Savings Of Epf Members At 54 Years Of Age Download Table

What Is The Ideal Savings According To Age Bracket Principal Asset Management

Mercer Nz On Twitter Retirement Age Country Savers

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Malaysia Savings Percent Of Gdp Data Chart Theglobaleconomy Com

Epf Announces 5 2 Dividend For Conventional Accounts 4 9 For Shariah Free Malaysia Today Fmt In 2021 Dividend Accounting Free Online

Savings Rate By Age Malaysians Download Table

From Sumeria To The Rise Of Modern Credit Scores The History Of Consumer Lending Consumer Lending Infographic Credit Companies

How Much Should I Have Saved By 45 To Be On Track For Retirement